Principles of Accounts

Principles of Accounts

Aims

The primary aim of the POA syllabus is to develop in students the knowledge and skills to prepare, communicate, and use both accounting information and non-accounting information related to business to make decisions.

The syllabus then aims to help students to become users of accounting information and make informed decisions using both accounting and non-accounting business-related information. Students will learn and understand the following:

- What business decisions are,

- How decisions are made using accounting information,

- The limitations of relying only on accounting information, and

- The consideration of non-accounting business-related information.

Examples of POA Learning Experiences in BDS

National Accounting Challenge

FedEx Express/JA International Trade Challenge

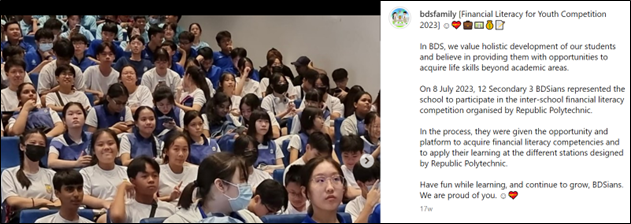

Financial Literacy for Youth Competition

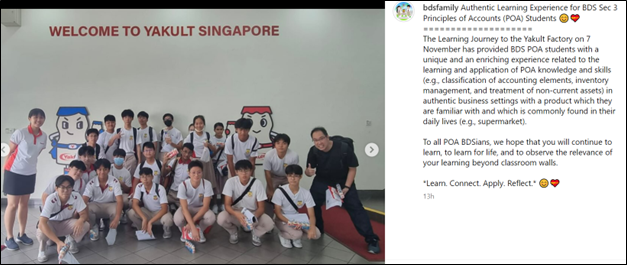

Learning Journeys

Links

Syllabus 7087: Singapore-Cambridge GCE O-Level

Syllabus 7086: Singapore Cambridge GCE N(A)-Level

Scheme of Assessment

There are two compulsory papers.

Syllabus 7087: Singapore-Cambridge GCE O-Level

| Details | Weighting | Duration | |

|---|---|---|---|

| Paper 1 | Answer 3 to 4 compulsory structured questions. (40 marks) | 40% | 1 hour |

| Paper 2 | Answer 4 compulsory structured questions. (60 marks) • One question requires the preparation of financial statements for a business for one financial year. (20 marks) • A scenario-based question (7 marks) will be part of one of the 3 remaining questions. |

60% | 2 hours |

Syllabus 7086: Singapore Cambridge GCE N(A)-Level

| Details | Weighting | Duration | |

|---|---|---|---|

| Paper 1 | Answer 3 to 4 compulsory structured questions. (40 marks) | 40% | 1 hour |

| Paper 2 | Answer 4 compulsory structured questions. (60 marks) • One question requires the preparation of financial statements for a business for one financial year. (20 marks) • A scenario-based question (5 marks) will be part of one of the 3 remaining questions. |

60% | 2 hours |